Credit Creation Theory of Banking

© Copyright Maurice Starkey 2018 and available for reproduction under a Creative Commons CC-BY-SA license. Download this as a Microsoft Word document. See also the video lectures on this topic on his YouTube channel.

What is Money?

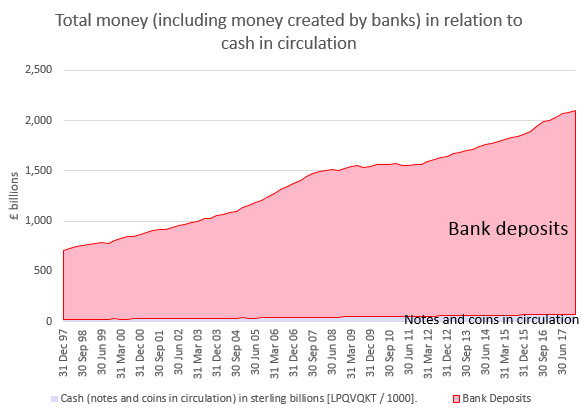

Money within the economy can take several forms. Cash (notes and coins) accounts for only 3% of the money in circulation, whilst the remaining 97% of the money in circulation within the United Kingdom economy comprises of credit money that has been created by banks (Ryan-Collins, Greenham, Werner, & Jackson, 2011).

Source: Bank of England (Bank of England, 2018)[1]

As previously stated, cash (bank notes and coins) account for approximately 3% of the money in circulation. Bank notes account for approximately 94% of the total cash in circulation, whilst coins account for the remaining 6% of cash in circulation.

Central bank reserves refer to commercial bank reserves that are held at the central bank (Bank of England in the United Kingdom), which are presented in the central bank’s electronic record of the amount owed by the central bank to each commercial bank to facilitate large scale payments between commercial banks. Central bank reserves are used to settle net amounts owed between commercial banks at the end of each working day. Central bank reserves do not circulate in the wider economy outside of the banking system, and so are not considered when presenting the total amount of money circulating within the economy. However, the central bank will convert electronic central bank reserves into physical notes and coins that circulate within the economy, at the request of a commercial bank. Commercial banks will request this conversion of central bank reserves into cash (bank notes and coins) when commercial banks require additional cash to satisfy the general publics demand for cash. Central bank money, which is also referred to as base money, comprises of both cash and central bank reserves.

Bank deposits account for approximately 97% of the money supply in the United Kingdom economy. Bank deposits are sometimes referred to as ‘credit money’, because the majority of bank deposits were originally created by banks issuing new loans. A bank creates credit money when generating a bank deposit that is a consequence of fulfilling a loan agreement, extending an overdraft facility, or purchasing assets. Credit money represents the total amount of money that is owed to banks by borrowers. Credit money is sometimes referred to as fountain pen money, because it is created with a stroke of a banker’s pen (or more usually today, by inserting numbers into a computer). The term credit money is a consequence of commercial bank’s IOU only remaining valid whilst the bank remains solvent. Bankruptcy of a bank would destroy a significant proportion, if not all, of the credit money created by a bank. The credit money component of money supply is reduced when money borrowed from a bank is repaid.

Bank deposits represent an IOU between a commercial bank and their customers, with customers including both individuals and organisations. Bank deposits can take a variety of forms, including current and deposit accounts. However, the government guarantees through the Financial Services Compensation Scheme the first £85,000 of an individual’s bank deposits, which can be considered to be money due to the government guaranteeing repayment of the money. Therefore, the term credit money only strictly applies to the amount of an individual’s deposits with a bank that exceeds the £85,000 limit of the Financial Services Compensation Scheme.

Credit Creation Theory of Banking

Whilst most textbooks discuss the money multiplier theory of credit creation, there is limited consideration within academic textbooks of the credit creation theory of banking. However, the Bank of England recently issued a paper which recognises the credit creation theory of banking as a useful theory for understanding the process of money creation (McLeay, Radia, & Thomas, 2014).

Credit creation theory of banking proposes that individual banks can create money, and banks do not solely lend out deposits that have been provided to the bank. Instead, the bank creates bank deposits as a consequence of bank lending. Consequently, the amount of money that a bank can create is not constrained by their deposit taking activities, and the act of bank lending creates new purchasing power that did not previously exist. The repayment of existing debt destroys money, as a consequence of reducing bank loans (asset side of balance sheet) and customer deposits (liability side of the bank balance sheet).

A bank’s ability to create new money, which is referred to as ‘credit money’, is a consequence of a range of factors. Firstly, non-cash transactions account for more than 95% of all transactions conducted within the economy, with non-cash transactions being settled through non-cash transfers within the banking system. Banks’ ability to create credit money arises from combining lending and deposit taking activities. Banks act as the ‘accountant of record’ within the financial system, which enables banks to create the fiction that the borrower deposited money at the bank. Members of the public are unable to distinguish between money that a bank has created, and money saved at the bank by depositors.

Banks’ ability to create credit money is also a consequence of being exempt from the ‘client money rules’. Regulations in the form of the client money rules prevent non-bank organisations creating credit money, because non-bank organisations (for example, stockbrokers, solicitors and accountants) are required to keep clients’ money separate from the non-bank organisation’s assets and liabilities on their balance sheet. However, banks' exemption from the client money rules enable banks torelabel liabilities on their balance sheet at different stages of the process when extending a loan, which enables banks to expand their balance sheets (Werner, 2014). Exemption from the client money rules enables banks to rename their account payable liability as a customer deposit, despite the money not being a consequence of a customer making a deposit. There is no law, statute or banking regulation that allows banks to reclassify their bank liabilities (accounts payable) as a fictitious customer deposit. Consequently, the legality of banks creating credit money is unclear. Banks' exemption from the client money rules also means that when a customer deposits money at their bank, the customer no longer owns the money and becomes a general creditor of the bank.

The following process represents the bank’s accounting entries associated with provision of a loan. The initial step is associated with the bank agreeing a loan with a customer, and the accounting treatment for the loan is the same approach followed by any other type of financial intermediary.

| Assets | Liabilities |

|---|---|

| Loan £10 | Account payable £10 |

The accounting entries associated with second stage of the process, when the bank places money into a borrower’s bank account, is the point at which the bank’s accounting treatment of the loan differs from other types of financial intermediary. A bank creates new credit money as a consequence of their accounting treatment of liabilities. The bank ledger converts the account payable arising from a bank’s lending activity to a customer deposit, where the customer deposit represents another category of bank liability. This accounting process causes the bank to create a new customer deposit that was not previously paid into the bank, but instead represented the reclassification of an account payable liability of the bank. This accounting treatment of the transaction enables the bank to expand both sides of their balance sheet at the same time when making a loan.

| Assets | Liabilities |

|---|---|

| Loan £10 |

Account payable £0 |

Seigniorage traditionally refers to the profit received by the central bank from creating new money, and is calculated as the difference between the cost of producing physical money and the purchasing power of the newly created money in the economy. For example, a £10 note can purchase £10 worth of products within the economy, but only costs a few pence to produce. However, given that commercial banks create the majority of money in an economy, we can also calculate commercial bank seigniorage acquired from bank credit creation. Credit creation increases bank profitability in two ways. Firstly, bank credit creation increases the volume of profitable bank lending opportunities the bank can conduct. Secondly, bank credit creation reduces the bank’s cost of capital, where the average interest rate paid on depositors’ balances that have been created by the bank is lower than the commercial market interest rate paid on bank debt that would otherwise have to be used to facilitate additional bank lending. It is estimated that commercial bank seigniorage profits from credit creation that arose from lowering banks cost of capital generated commercial banks an annual £23 billion of addition profit per annum during the period 1998 to 2016 (Macfarlane, Ryan-Collins, Bjerg, Nielsen, & McCann, 2017, p. 2). Whilst state seigniorage profits from issuing bank notes are estimated to have generated approximately £1.2 billion per annum. Commercial bank seigniorage profit (CBS) is calculated using the following formula (Macfarlane, Ryan-Collins, Bjerg, Nielsen, & McCann, 2017, p. 18):

CBS = CBD (imb – id )

Where:

CBD = Commercial bank deposits

imb = commercial benchmark market interest rate

id = interest rate paid by banks on depositors’ money

Bank lending is determined by the existence of profitable lending opportunities. Bank lending activity is influenced by the demand for bank loans. Richard Werner proposes that Say’s Law can be applied to credit creation, because increasing the supply of credit creates its own demand. Lending secured on dwellings accounts for 49.6% of total United Kingdom bank lending in 2017. The consequence of creating new money to purchase an asset that is fixed in supply, such as property, promotes rising property prices that will encourage greater demand for borrowing to purchase property[2].

Bank lending activity is constrained by the need to remain profitable. Bank profitability is a consequence of interest received on loans exceeding interest charges on bank liabilities (which includes the interest paid on money deposited at the bank, interest received by bank bondholders, and dividends to bank shareholders). The difference between interest received on bank loans and the bank’s cost of capital is then used to cover the bank’s cost of provisions for bad and doubtful debts and operating costs of the bank, and the remainder is bank profit.

Banks money creation capability is constrained by their motivation to ensure there is an appropriate spread between the interest rate received on money loaned, and the cost of bank capital. A rapid expansion of bank lending will require the bank to reduce the interest rate charged to borrowers, which will reduce bank profitability. A bank must also ensure that it has sufficient provisions and capital to cover unanticipated losses arising from bad and doubtful debts, whilst also meeting regulatory requirements.

Creation of ‘credit money’ is determined by a commercial bank’s confidence that issued loans will be repaid. Therefore, banks perception of ‘credit default risk’ is an important factor influencing the amount of bank lending. Strong growth in property prices over a prolonged period of time reduces bank’s perception of the level of credit default risk associated with property lending, because money owed as a consequence of the borrower’s failure to repay a loan will be recovered by the bank repossessing the property that provided security for the loan. Secondly, borrowers are likely to repay loans whilst the asset value exceeds the total amount of money outstanding on the loan. When property prices are continuously increasing the bank will perceive that property lending incurs a very low credit default risk, and will therefore attribute a very low level of credit default risk when lending for property purchase. Levels of credit default, and bank provisions for bad and doubtful debts, are likely to increase substantially in the event of a significant reduction in property prices.

It is alleged that Barclay’s Bank innovated a further step to the bank credit creation process, when they offered to provide a third-party with a loan, on the understanding that the third party purchased newly created shares in Barclay’s Bank (Financial Times, 2018). The Serious Fraud Office have charged Barclays Bank with financial assistance as a consequence of this transaction, because a company is not allowed to loan money for the purpose of purchasing their own shares. If a bank was allowed to pursue this approach to raising capital it would remove an important constraint on a bank’s ability to increase lending. This process caused an account payable liability to be converted into a customer deposit liability, which then became new Barclays Bank share capital when the third-party used their loan to purchase new Barclay’s share capital (another category of liability on Barclay’s balance sheet) (Werner, 2014).

| Assets | Liabilities |

|---|---|

| Loan $3 billion |

Account payable |

The credit creation theory of banking is discussed in more detail within the electronic mind maps that I have created, which are located on the Economics Network (Starkey, 2017).

Bibliography

Financial Times. (2018, February 12th). Barclays charged a second time over Qatar cash injection. Retrieved from Financial Times: https://www.ft.com/content/9eb75568-0fcf-11e8-8cb6-b9ccc4c4dbbb

Macfarlane, L., Ryan-Collins, J., Bjerg, O., Nielsen, R., & McCann, D. (2017, January). Making Money from Making Money: Seigniorage in the Modern Economy. Retrieved from New Economics Foundation: http://neweconomics.org/wp-content/uploads/2017/05/NEF_MAKING-MONEY-OUT-OF-MONEY_amendment_E.pdf

McLeay, M., Radia, A., & Thomas, R. (2014). Money creation in the modern economy. Retrieved from Bank of England: https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf?la=en

Ryan-Collins, J., Greenham, T., Werner, R., & Jackson, A. (2011). Where Does Money Come From? A Guide to the UK Monetary and Banking System. London: New Economics Foundation.

Starkey, M. (2017, September). Interactive mind maps in economics. Retrieved from The Economics Network: http://www.economicsnetwork.ac.uk/archive/starkey_mindmaps/

Werner, R. (2014). How do banks create money, and why can other firms not do the same? An explanation for the coexistence of lending and deposit taking. International Review of Financial Analysis (36), 71 - 77. DOI: 10.1016/j.irfa.2014.10.013

Footnotes

[1] Notes and coins in circulation held outside the banking system by the non-bank private sector comprise the liabilities of the Bank of England (bank notes) and government (coins in circulation), but excludes the notes and coins held by the commercial banking system within their tills and cash machines. Data relating to notes and coins in circulation is acquired from the Bank of England dataset ‘quarterly amounts outstanding of M4 private sector sterling holdings of notes and coin (in sterling billions) not seasonally adjusted’ [which is dataset LPQVQKT]. Sterling M4ex (excluding intermediate OFCs (other financial corporations)) measures broad money in circulation by presenting the deposit liabilities of banks and building societies, whilst excluding commercial bank reserves held at the Bank of England. Sterling M4ex was acquired from Bank of England dataset ‘quarterly amounts outstanding of UK resident monetary financial institutions' sterling M4 liabilities to Private sector excluding intermediate OFCs (in sterling billions) not seasonally adjusted’ [Bank of England dataset RPQB3DQ] to calculate the total amount of money in circulation for the purpose of calculating the total value of commercial bank credit money (liabilities of commercial banks). The total value of commercial bank credit money is obtained by calculating the difference between these two values.

[2] The central bank also influences demand for loans when setting the central bank base rate. A lower interest rate encourages increased bank borrowing, as a consequence of reducing borrowers cost of bringing forward future consumption. The central bank also influences demand for bank borrowing by influencing wider economic conditions, as a consequence of the central bank’s monetary policy stance.

See also

- Two-part video lecture: Bank Deposit Creation and the Quantity Theory of Credit (Part A) | (Slides for part A) | (Part B) | (Slides for part B)